🗓️ Published: April 12, 2025

Jake's Story: From Side Hustle to Thriving Small Business

Follow Jake’s journey as he navigates challenges, learns the ropes, and turns his small idea into a sustainable business success.

📝 Welcome to The Independent Business blog — your go-to resource for real-world tips on pricing, profit, and running a small business smarter. We share guides, tools, and stories to help you make better decisions with confidence.

🗓️ Published: April 12, 2025

Follow Jake’s journey as he navigates challenges, learns the ropes, and turns his small idea into a sustainable business success.

🗓️ Published: April 12, 2025

Get the lowdown on the essential types of insurance every UK small business should have, and how to stay protected.

🗓️ Published: April 7, 2025

A beginner’s guide to setting up a successful pop-up or street food stall in the UK.

🗓️ Published: March 29, 2025

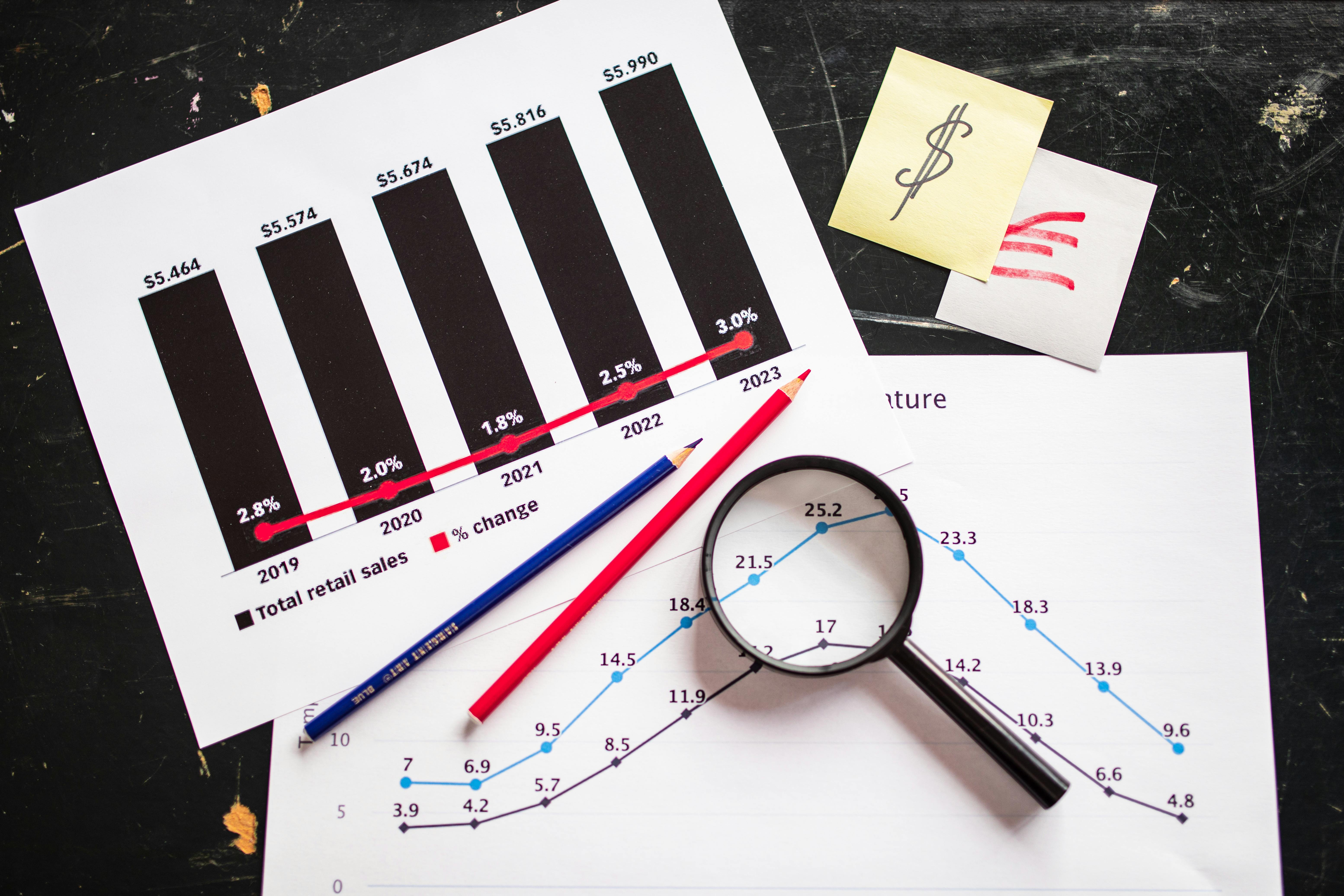

Discover actionable tips for setting the perfect price point for your products.

🗓️ Published: March 28, 2025

Explore simple and effective ways to reduce your business overhead.

🗓️ Published: March 21, 2025

Understand the basics of pricing, cost, and profit in simple terms.

🗓️ Published: March 18, 2025

Learn how to efficiently track business costs with modern tools and techniques.

🗓️ Published: March 14, 2025

Everything you need to know to launch a successful food cart or street vendor business.

🗓️ Published: March 11, 2025

Understand the crucial difference between profit and cash flow, and why both matter.

🗓️ Published: March 7, 2025

Learn how to define realistic goals to grow your small business sustainably.