Understanding Profit Margins: A Guide for Small Business Owners

🗓️ Published: March 21, 2025

🎧 Listen to this article

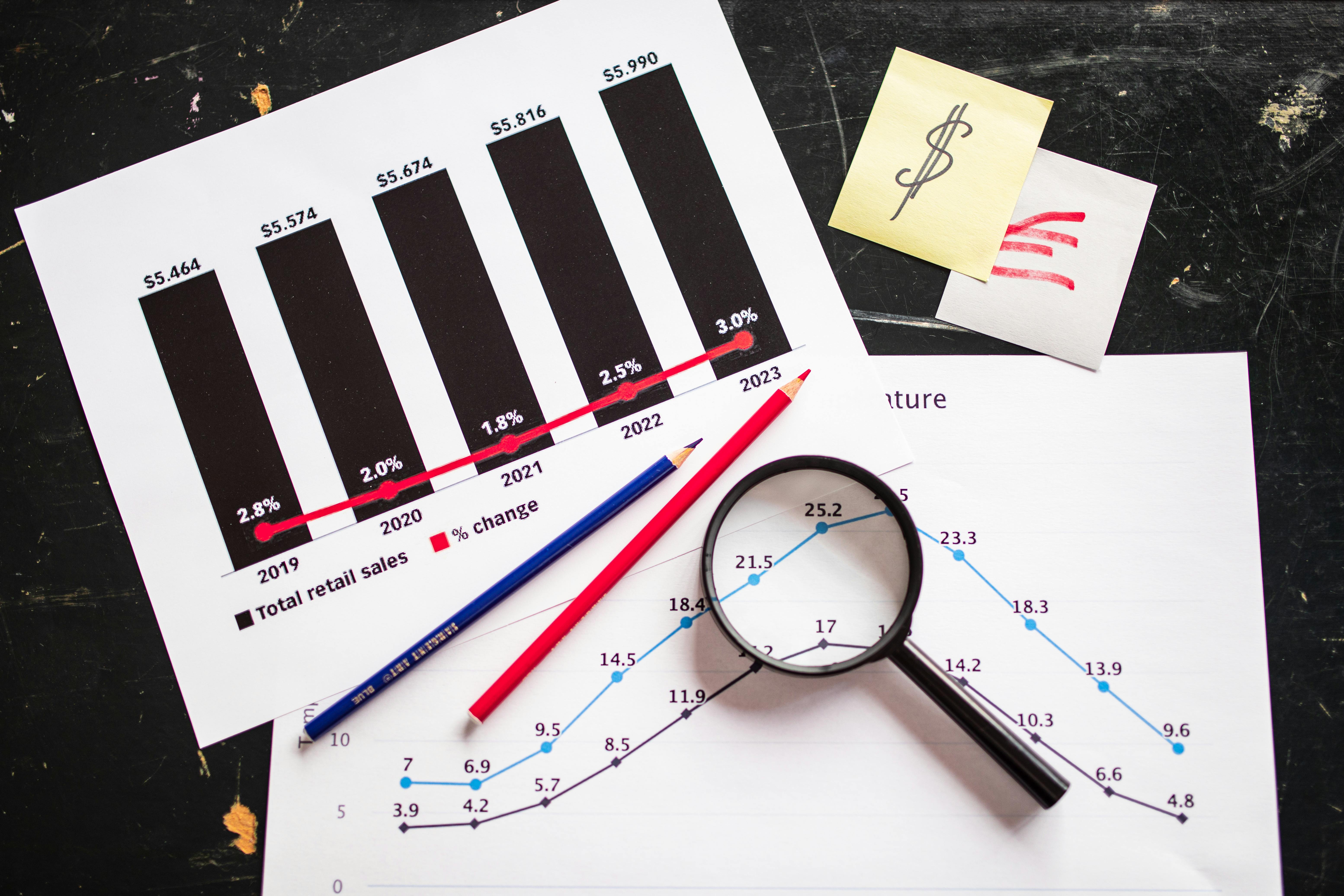

Image via Pexels

Image via Pexels

Profit margins are one of the most important financial metrics in any business, yet many small business owners overlook their significance. Understanding profit margins can help entrepreneurs make informed decisions about pricing, expenses, and overall financial health.

If you’re running a small business or thinking about starting one, you need to know how to calculate and improve your profit margins. This guide will walk you through the essentials, explain key formulas, and provide actionable strategies to maximize your profitability.

What is Profit Margin?

Profit margin is a percentage that indicates how much of your revenue remains as profit after accounting for all expenses. It reflects the financial health of your business and determines whether your pricing strategy and cost management efforts are effective.

Types of Profit Margins

- Gross Profit Margin – Measures profit after deducting the cost of goods sold (COGS), which includes materials and direct labor.

- Operating Profit Margin – Accounts for operating expenses such as rent, utilities, and payroll.

- Net Profit Margin – The most comprehensive metric, considering all expenses, including taxes and interest.

How to Calculate Your Profit Margin

The formula for net profit margin is straightforward:

Net Profit Margin (%) = (Net Profit / Total Revenue) × 100

Definitions:

- Net Profit = Total Revenue - Total Expenses

- Total Revenue = The sum of all sales before deductions

- Total Expenses = COGS + operating costs + other expenses

Example: If your business generates $100,000 in revenue and has $70,000 in total expenses, your net profit is $30,000.

Net Profit Margin = ($30,000 / $100,000) × 100 = 30%

What is a Good Profit Margin?

Good profit margins vary by industry. Here are some common benchmarks:

- Retail: 2–10%

- Restaurants: 3–5%

- Professional Services: 15–30%

- E-commerce: 10–20%

- Manufacturing: 10–15%

How to Improve Your Profit Margins

1. Reduce Operating Costs

- Negotiate with suppliers for better pricing.

- Cut unnecessary expenses like unused subscriptions.

- Automate tasks with software to reduce labor costs.

2. Optimize Pricing Strategy

- Increase prices gradually.

- Introduce tiered pricing for premium options.

- Bundle products/services to encourage larger purchases.

3. Focus on High-Margin Products or Services

- Promote high-profit items more aggressively.

- Upsell or cross-sell premium products.

4. Improve Efficiency and Productivity

- Train employees to enhance productivity.

- Streamline operations to reduce inefficiencies.

- Invest in technology to automate repetitive tasks.

5. Reduce Customer Acquisition Costs

- Encourage referrals and word-of-mouth marketing.

- Use cost-effective digital marketing (SEO, social media, email).

- Focus on customer retention for long-term revenue.

Common Mistakes That Hurt Profit Margins

- Undervaluing products/services, leading to low profits.

- Ignoring financial reports and missing problem areas.

- Expanding too quickly without stable revenue.

- Over-relying on discounts, reducing profitability.

Final Thoughts: Profitability is Key to Business Success

Understanding and improving profit margins is essential for long-term success. By optimizing pricing, reducing costs, and focusing on high-margin products or services, you can build a more profitable and sustainable business.

Regularly analyze your financial metrics, stay informed about industry trends, and continuously seek efficiency improvements. By doing so, you’ll position your small business for growth and long-term success.

Disclaimer: This content is provided for general informational purposes only and does not constitute financial, legal, or professional advice. Always consult a qualified advisor or relevant authority before making decisions based on this information. While we strive to ensure accuracy, we make no guarantees regarding the completeness, reliability, or applicability of the content for your specific situation.